flow through entity taxation

Log on to Michigan Treasury Online MTO to update. You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following.

Salt Limitation And The New York State Pass Through Entity Tax Ptet By Adam E Panek Cpa Partner Grossman St Amour Cpas Pllc

This guidance is expected to be published in early January 2022 and will be posted to the Departments website.

. However the late filing of 2021 FTE returns will be. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. Understanding What a Flow-Through Entity Is.

Instructions for Electing Into and Paying the Flow-Through Entity Tax Taxpayer Notice. Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated. For further questions please contact the Business Taxes Division.

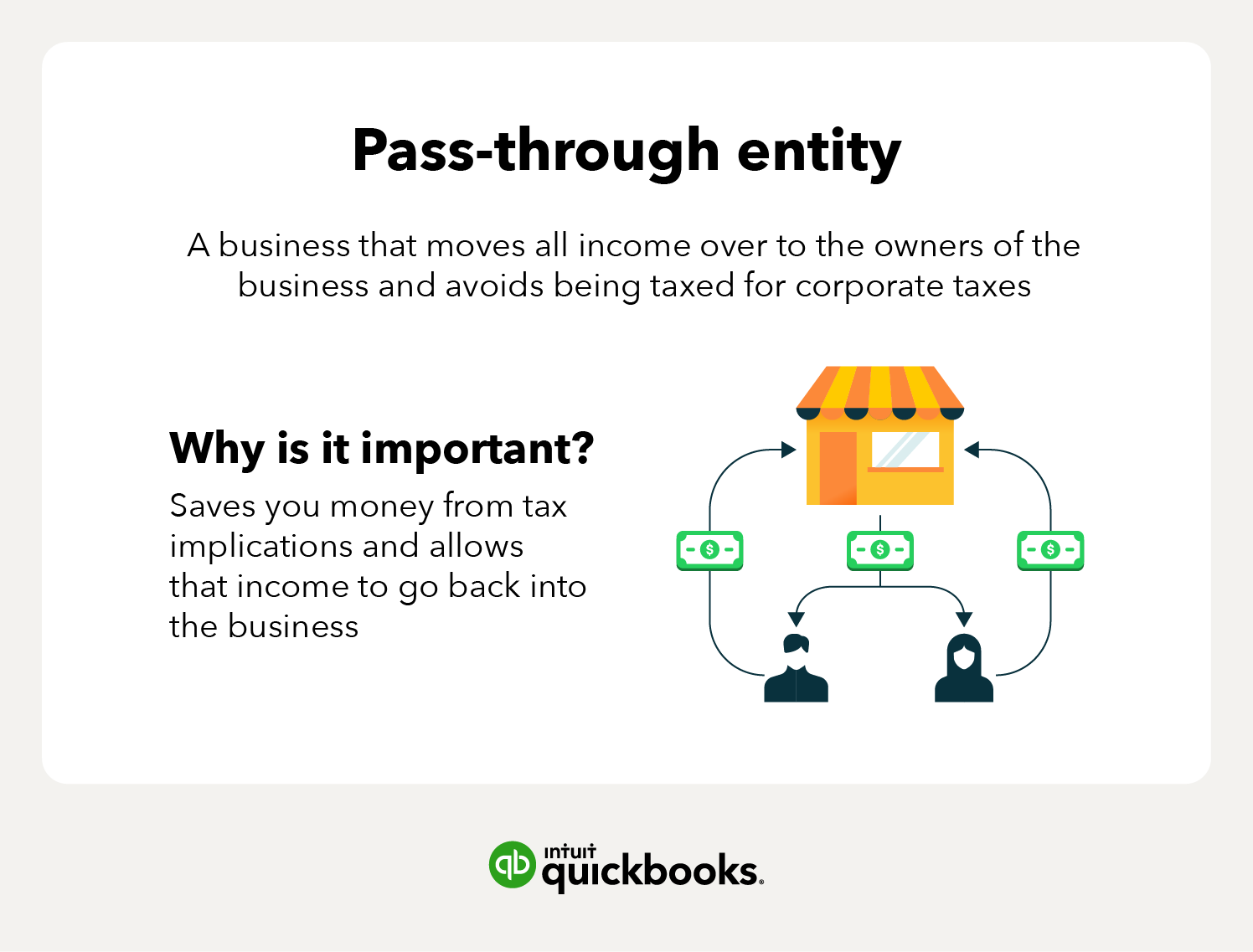

That is the income of the entity is treated as the income of the investors or owners. A flow-through entity is also called a pass-through entity. Flow-Through Entity Tax - Ask A Question.

Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. Flow-through entities are considered to be pass-through entities. The entitys income only goes through a.

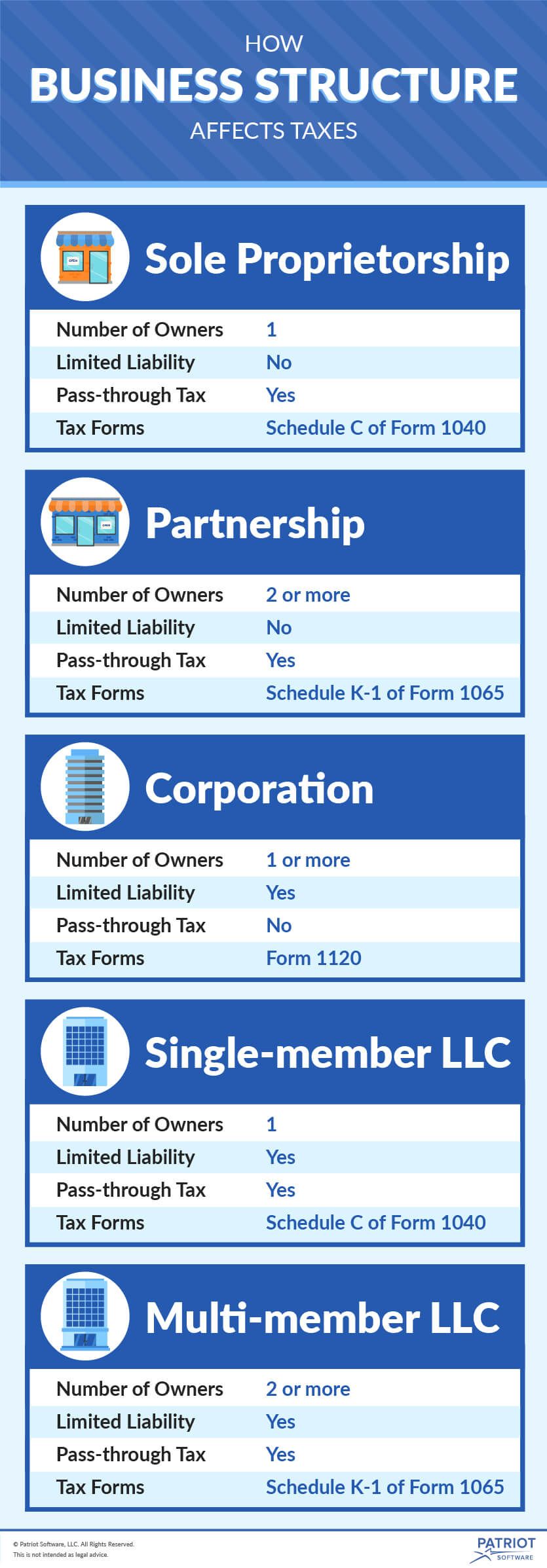

Changes to 9-1-1 Under Senate Bill 400 PA 51 Filing Deadlines and Due Dates New Marihuana. Types of Pass-Through Entities. A flow-through entity FTE is a legal entity where income flows through to investors or owners.

The range of features that comprise each method of taxation entity taxation and flow-through taxation are set out in previous work see here and here. Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax. Is elected and levied on the Michigan portion of the.

This means that the flow-through entity is responsible. A trust maintained primarily for the benefit of. As a result only the individuals not the business are taxed.

A flow-through entity is a business in which income is passed straight to its shareholders owners or investors. There are two major reasons why owners choose a flow-through entity. Limited liability companies partnerships and subchapter S corporations have so-called flow through taxation That means that the entity files a tax return but the taxes are.

With sole proprietorships LLCs partnerships and S corporations business income flows through to the business owners and is taxed only at the individual. Because of the increasing use of such flow through entities for a variety of business issues at the state level continue to assume even greater prominence. Advantages of a Flow-Through Entity.

Instead their owners include their allocated shares of profits in. Deloitte specialists in flow-through and partnership tax compliance can help you understand and evaluate the tax-rate reductions incentives and thresholds applicable to your current business. Effective January 1 2021 the Michigan flow-through entity FTE tax is levied on certain electing entities with business activity in Michigan.

My recent article critically analysed.

Pass Through Entity Taxes And Business Types Explained

Pass Through Entity Tax 101 Baker Tilly

State Pass Through Entity Taxes Let Some Residents Avoid The Salt Cap At No Cost To The States Tax Policy Center

Georgia S Pass Through Entity Tax Election Offers Salt Cap Workaround Mauldin Jenkins

State Pass Through Entity Taxes

Pass Through Business Income And 2018 Tax Reform Doe Ticker Tape

Optional Pass Through Entity Tax Wolters Kluwer

The New York Pass Through Entity Tax Election Freed Maxick

What Is A Pass Through Entity Northwest Registered Agent

New York State Pass Through Entity Tax Sciarabba Walker Co Llp

Pass Through Entity Definition Examples Advantages Disadvantages

Michigan Flow Through Tax Act Webinar Youtube

Flow Through Entities Income Taxes 2018 2019 Youtube

Pass Through Entity Definition And Types To Know Quickbooks

Business Entity Tax Basics How Business Structure Affects Taxes

Workshop Navigating The State S Pass Through Entity Tax

The California Elective Pass Through Entity Tax Provides Business Owners A Salt Cap Tax Credit Workaround

Rsm Tax Summit Pass Through Entity Taxes At The State And Local Level Addressing Salt Loopholes Youtube

California S Pass Through Entity Tax Summary Examples And Frequently Asked Questions Faqs Singerlewak