mississippi income tax rate 2021

Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 S Corporation Income Tax Laws. Taxable and Deductible Items.

Individual Income Tax Structures In Selected States The Civic Federation

0 on the first 3000 of taxable income.

. 80-160 Credit for Tax Paid. 80-115 Declaration for E-File. At what rate does Mississippi tax my income.

For single taxpayers your gross income must be more than 8300 plus 1500 for each dependent. Mississippi has a graduated income tax rate and is computed as follows. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

Find your pretax deductions including 401K flexible account contributions. 4 on the next 5000 of taxable income. Tax rate of 4 on taxable income between 5001 and.

80-155 Net Operating Loss Schedule. Title 27 Chapter 8 Mississippi Code. Tax Rates Exemptions Deductions.

This marginal tax rate means. If youre married filing taxes jointly theres a tax rate of 3 from 4000. There is no tax schedule for Mississippi income taxes.

Tax rate of 0 on the first 5000 of taxable income. As you can see your income in Mississippi is. Detailed Mississippi state income tax rates and brackets are available on.

Mississippi Income Taxes. The graduated income tax rate is. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5.

Married taxpayers must make more than 16600 plus 1500 for each. The next 1000 is taxed at 3. Your average tax rate is 1198 and your marginal.

The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. Mississippi also has a 400 to 500 percent corporate income tax rate.

Check the 2021 Mississippi state tax rate and the rules to calculate state income. Detailed Mississippi state income tax rates and brackets are available on. The next 5000 of taxable income is taxed at 4.

27-7-5 and 27-7-18 Beginning with tax year 2018 the 3 tax rate on. Tax credit from January 1 2022 to January 1 2026. 3 on the next 1000 of taxable income.

Mississippi Tax Brackets for Tax Year 2021. 3 on the next 2000 of. In tax year 2021 only 1000 in marginal income will be subject to the 3 percent rate with the other 1000 exempt.

Your average tax rate is 1350 and your marginal tax rate is 22. Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent. Corporate Income Tax Returns 2021.

Income Tax Laws Title 27 Chapter 7. If filing a combined return both spouses workeach spouse c See more. 5 on all taxable income over 10000.

Senate Bill 2858 2016 Legislative Session - Miss. 80-108 Itemized Deductions Schedule. 80-107 IncomeWithholding Tax Schedule.

If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. 0 on the first 4000 of taxable income. For single taxpayers living and working in the state of Mississippi.

Mississippi Income Tax Calculator 2021. Starting in 2022 only the 4 percent and 5 percent rates will. If you make 82500 a year living in the region of Mississippi USA you will be taxed 14847.

Find your gross income. The first 4000 of taxable income is exempt. Because the income threshold for the top.

How do I compute the income tax due.

Mississippi Tax Rate H R Block

Mississippi Ranks 30th In 2022 Tax Foundation State Business Tax Climate Index Mississippi Politics And News Y All Politics

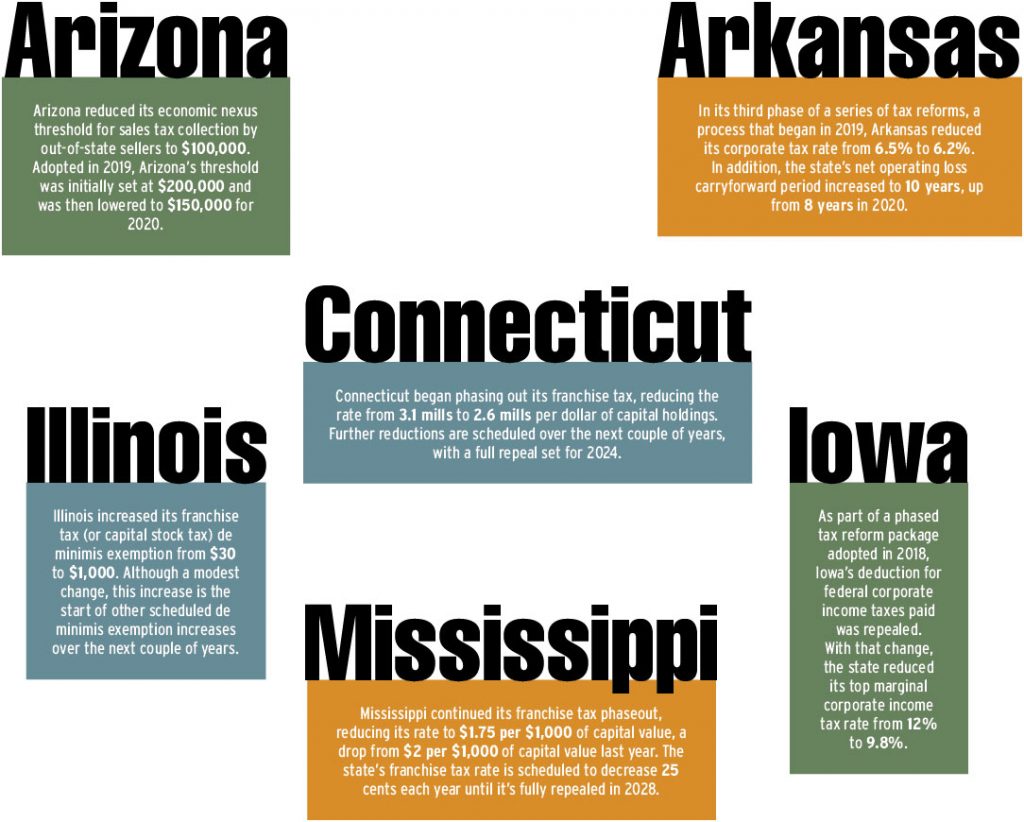

State Tax Updates In 2021 Tax Executive

Commentary Mississippi Should Invest In Its People Not Chase The False Promise Of Tax Competitiveness Center On Budget And Policy Priorities

How Long Has It Been Since Your State Raised Its Gas Tax Itep

State Corporate Income Tax Rates And Brackets Tax Foundation

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

State Sales Tax Rates Sales Tax Institute

Mississippi State Tax H R Block

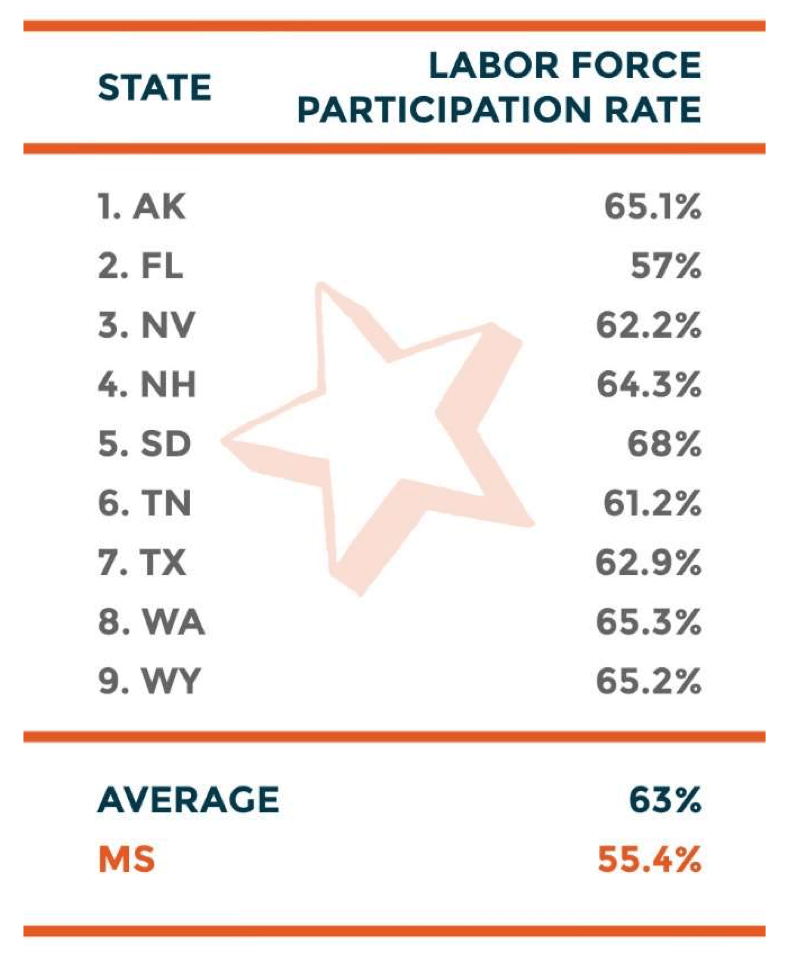

The Economies Of Income Tax Free States

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi Income Tax Phase Out Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

Mississippi Income Tax Reform Details Evaluation Tax Foundation